Medical insurance for Thailand

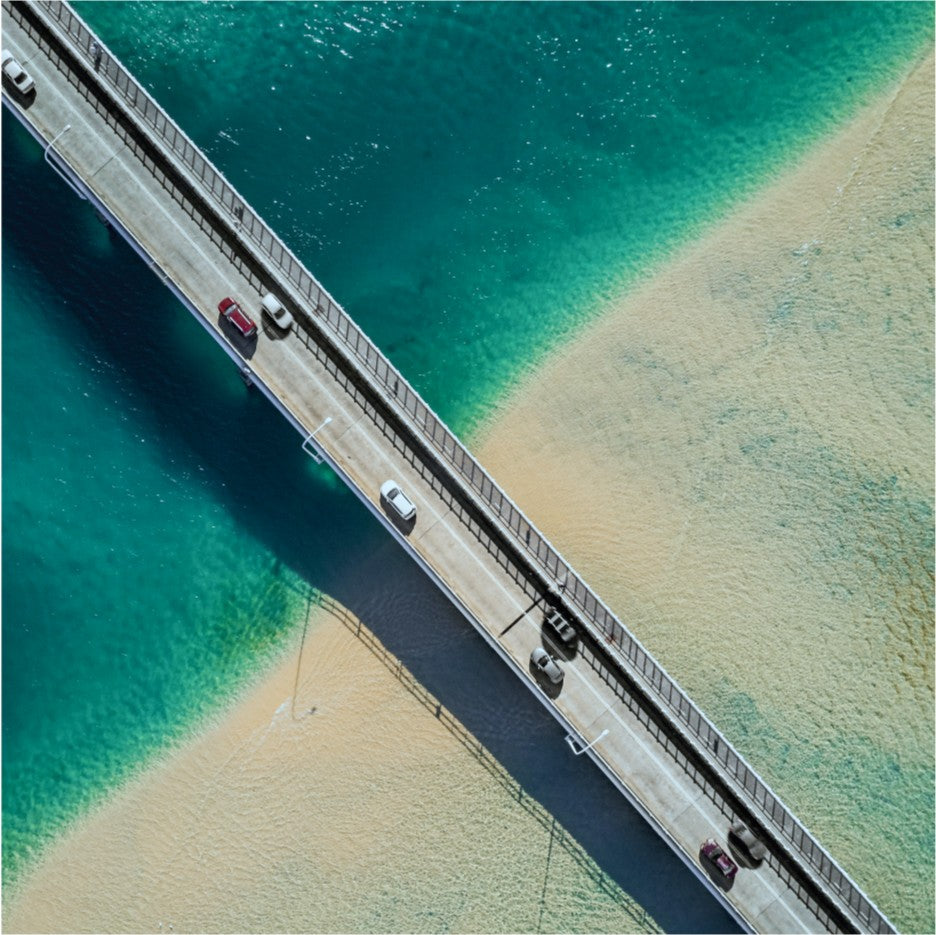

A complete guide to the Phi Phi Islands: beaches, attractions, excursions and tips for independent travelers. What to see and how to organize a trip.

One of the most important tasks that a traveler to Thailand faces is insurance and drawing up an insurance contract. Although this issue is often overlooked, negligence in medical matters often comes back to haunt you, and you have to spend significant amounts on medical bills.

Consequences of Negligence

The gold standard is to get good medical insurance before flying to Thailand. Although there is no doubt about the quality of medicine in Thailand, one visit to the hospital can cost you at least a thousand baht (if you need a general practitioner), and the maximum bills exceed the threshold of tens of thousands of baht (if in addition to a specialist, outpatient treatment is also required). But this is not the limit: operations and hospitalization can cost millions of baht. If you want to see real examples of such cases, it is easy to find many sad stories on the Internet. For the same reason, you can find dozens of charity collections to cover debts to Thai hospitals.

Insurance mechanism and package tours

Package tours include medical insurance automatically. However, this does not exempt you from reading the contract, because the nuances are in the details.

The insurance itself is an insurance contract between the traveler and the insurance company. It is a mandatory part of the tourist package of all tour operators, and because of this, some contracts have logos or other symbols of travel agencies. But this creates confusion: it is important to remember that the insurance company is not the property or subsidiary of the tour operator, and the travel agency is not involved in insurance issues.

Formally, these organizations are not bound by anything in the case of a specific tourist - the tour operator is not a party to the insurance contract. Neither the guide nor any other employee of the tour operator has the right or authority to influence the contract, cannot conclude it, terminate it, "force" it to work and, moreover, is not responsible for the actions of the insurance company. There are only two parties to the contract: THE TOURIST HIMSELF and THE INSURANCE COMPANY. Therefore, carefully study this document.

The standard option is the minimum package of services with the lowest insurance amount. If you are pregnant, traveling with children or elderly relatives, we strongly recommend extended insurance. It can also include services for Dengue, animal bites and injuries due to active sports. The latter group even includes snorkeling.

Of course, one would hope that you will not need this precaution. However, cases when, due to an accident or unexpected event, you have to get into debt, ask your relatives for a large transfer, or open a collection online, are more common than it seems. A little reinsurance will help you avoid this sticky situation.

Insurance for independent travel

If everything is clear with a package tour - a minimum insurance package is included in the tour package, then independent tourists often forget about taking out insurance. You should never do this. Many people use insurance from banks where they have accounts. But sometimes these insurance packages do not cover cases abroad. Be sure to check this before you start your trip. You can get additional medical insurance and accident insurance from any insurance company; for ease of selection, you can use the Cherehapa aggregator.

If you plan to engage in active sports or rent a motorbike, do not forget to include this in the coverage of the contract.

How to use insurance

The first steps will be as follows:

- Call the number on your insurance contract. If you are not sure that you will be able to call before the trip, it is worth clarifying the possibility of contacting the insurance company in other ways - for example, via messengers. This option will also help if the account suddenly runs out of funds or there is no roaming. Then connect to the Wi-Fi network in any hotel or cafe and establish contact.

- follow the instructions of the agents. It is the employees of the insurance company who decide the issues of hospitals. We recommend that you find out in advance what the terms of using the insurance are (is there a deductible, is transportation to the hospital included in the bill, what package of documents is required to take to the hospital to receive payment, or does your insurance company pay the bills directly).

“If the excursion is not taken at the hotel, the insurance does not work” - myth or reality?

Definitely a MYTH. No type of insurance contains a condition that you need to buy excursions only from your guide or a specific tour company. The insurance contract is valid for the entire agreed period of travel, even if you travel independently (renting a car sharing, using public transport or hitchhiking) or use the services of local agencies. For example, our passengers are additionally insured by the carrier's insurance company. You can see this document at the bottom of each page by clicking on the link "terms of agreement and company documents".

This applies to both land and sea excursions and transfers - passengers are automatically additionally insured. It is mandatory for the carrier to insure all transport and its passengers, otherwise it will not receive permission to work in the tourism sector. We are vigilant about the presence and correctness of filling out all the papers and check the quality of services.

The article is prepared for informational purposes. We are a travel agency and can offer you our services for organizing your vacation - excursions to islands and national parks , transport rental , as well as rental and sales services real estate . To contact the manager, click the button below and fill out the feedback form.